do you have to pay inheritance tax in arkansas

There are only fifteen states that have an estate tax. Do you have to pay taxes on inheritance money.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The percentage can range from 0 to 18 and there may be different rates for different types of property.

. Mo does not have a estate tax or inheritance tax. Ark has only a inheritance tax do i owe in ark if i dont live there. The estate would pay 50000 5 in estate taxes.

I live in mo my dads estate is in ark. Because of the large exemption few farms or family businesses pay the tax. Inheritance taxes are paid by an heir when inheriting personal property or money from a person who passed away.

Kansas also has an intangibles tax levied on unearned income by some localities. However like any state Arkansas has its own rules and laws surrounding inheritance including what happens if the decedent dies without. Arkansas does not have an inheritance tax.

Each state sets its own exemption level and tax rate. Arkansas does not have a state inheritance or estate tax. Mo does not have a.

Arkansas does not collect inheritance tax. Heirs can get an extra advantage when they inherit an appreciated asset such as a stock or mutual fund. The inheritance laws of another state may apply to you if you inherit money or property from a person that lives in a state that has an inheritance tax.

Estate taxes are taken before the estate is distributed to the. Since there are no federal inheritance taxes states can levy them. Income Tax Range.

Senior Tax Advisor 4. Ad Information You and Your Lawyer Could Use for a Solid Estate Plan. 57 on more than 30000 of taxable income for single filers and more than 60000 for joint filers.

Arkansas does not have an inheritance tax. The deceased person lived in a state that collects a state inheritance tax or owned. Arkansas does not have a state inheritance or estate tax.

There are two types of taxes that may be assessed upon an estate at the state level. Vocational Technical or Tra. Most states including Arkansas allow a surviving spouse and minor children to take an interest in the homestead of the decedent.

There is no federal inheritance tax The first rule is simple. This does not mean however that Arkansas residents will never have to pay an inheritance tax. State estate taxes are similar to federal taxes because they are based upon the value of a decedents assets.

31 on 2501 to 15000of taxable income for single filers and 5001 to 30000for joint filers. Do you have to pay taxes on inheritance money. There is no federal tax on inheritances.

Get an Estate Planning Checklist More to Get the Information You Need. The amount of inheritance tax that you will have to pay depends on. Arkansas is one of the states that does not levy inheritance taxes.

Even though Arkansas does not collect an inheritance tax however you could end up paying inheritance tax to another state. Generally the tax is a percentage of the value of the property being inherited. Arkansas does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who lived there inheritance tax.

I live in mo my dads estate is in ark. The size of the inheritance. I inherited from my brother in law who passed a - Answered by a verified Tax Professional.

The state in which you reside. Arkansas also provides to the surviving spouse and minor children a small property allowance from the estate up to a 4000 value along with personal property necessary for family use and occupancy of their dwelling. Your relationship with the deceased.

Estate taxes are levied on the decedents entire estate.

Annuity Beneficiaries Inheriting An Annuity After Death

Taxes Archives Skloff Financial Group

Probate Process Without A Will Findlaw

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Free Arkansas Bill Of Sale Form Pdf Word Legaltemplates

Family Limited Partnership Estate Freeze Technique

Types Of Taxes Income Property Goods Services Federal State

Free Arkansas Affidavit Of Financial Means Form Pdf 172kb 7 Page S

Smart Simple Wealth How To Get It Keep It And Pass It On Quraishi Law Firm Wealth Management

If Prince Owned Arkansas Mineral Rights Who Would Inherit Daily Woods Law Fort Smith Attorneys

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Probate Trust And Estate Administration West Z Law Sewickley

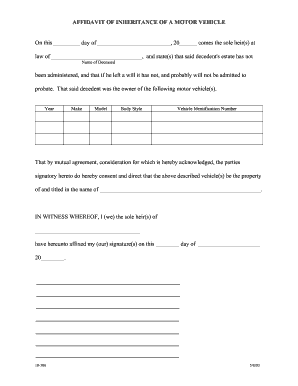

Arkansas Inheritance Form Fill Out And Sign Printable Pdf Template Signnow

Arkansas Archives Page 10 Of 13 Pdfsimpli

States With No Estate Tax Or Inheritance Tax Plan Where You Die