estate tax changes in reconciliation bill

The Infrastructure Bill passed the House and President Biden signed it into law on November 15th yet Congress continues to debate the repayment details of the Budget. The latest draft of the US Congress budget reconciliation Bill omits most of.

The Tax Cuts And Jobs Act Doesn T Comply With The Byrd Rule Committee For A Responsible Federal Budget

This analysis was updated to contain the November 4th amended changes to the cap on the state and local tax SALT deduction.

. The Build Back Better Framework released. It depends what day it is. Death in 2022.

Starting January 1 2026 the exemption will return to 549 million. The House budget reconciliation bill HR. Effective January 1 2022 the lifetime federal estate and gift tax exclusions will be reduced from the current 117 million exemption to the 2010 level which would be.

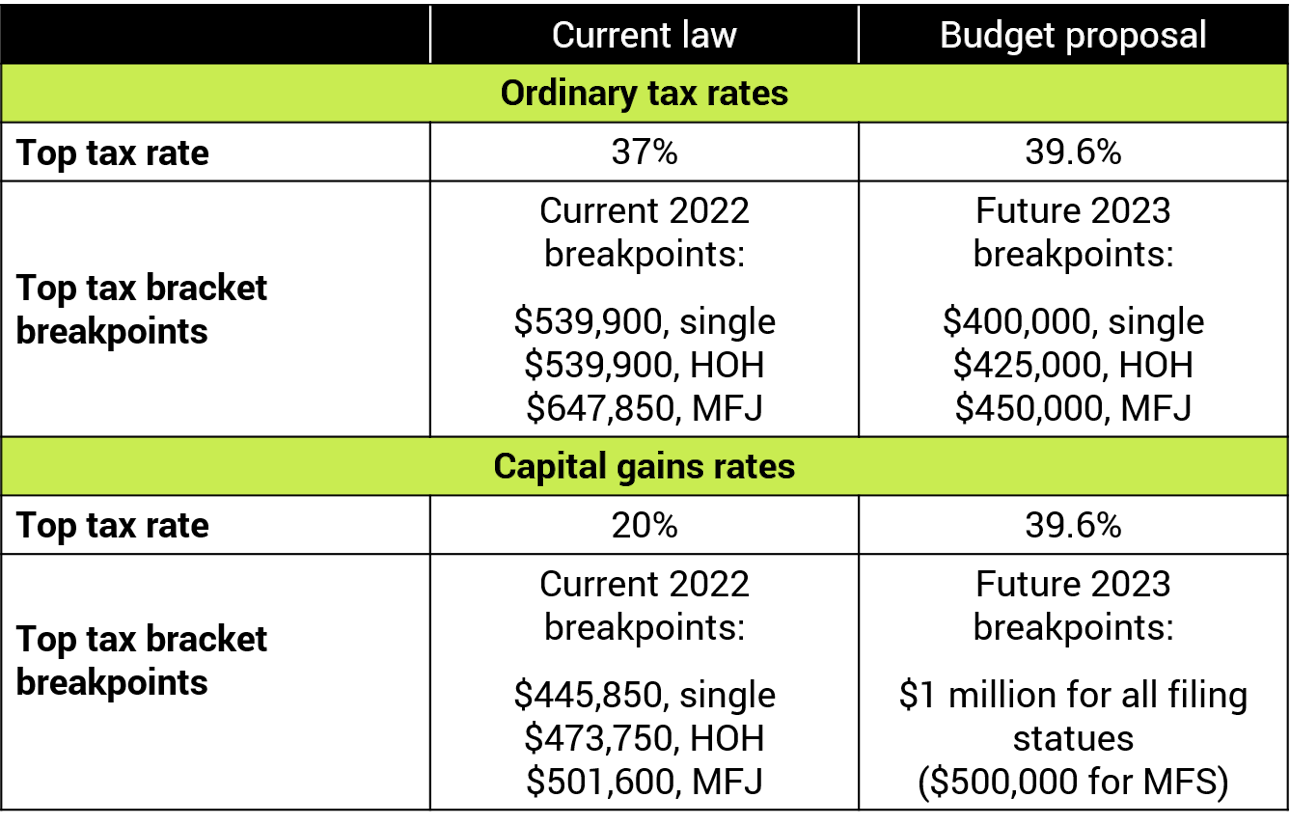

Increases to the income tax rates. Major tax changes in draft reconciliation bill. The bill provides that taxpayers with AGI of 400000 or more and all trusts and estates would only be allowed to exclude 50 of the eligible gain.

Estate Tax 15000000 X 40 6000000. Even without any act of Congress the exclusion will be cut in half effective. As negotiations over spending and taxes in a potential budget reconciliation bill tentatively the Build Back Better Act are ongoing in.

No Changes to the Current Gift and Estate Exemption Provisions Until 2025. It is scheduled to revert to 5 million plus inflation in 2026. Growth and Tax Relief Reconciliation Act of 2001 EGTRRA.

A 5 surtax on individual income in excess of 10 million per year with an additional 3 on income in excess of 25 million. Revised Build Back Better Bill Excludes Major Estate Tax Proposals In late October the House Rules Committee released a revised version of the proposed Build Back Better Act. Trust Estate Strategies Protected in New Tax Proposal November 15 2021 The new reconciliation bill that was introduced in the House of Representatives eliminates some of.

That would be a significant change for anyone with an employer-sponsored plan allowing after-tax contributions and for people who have the financial means to save beyond. The bill is over 800 pages long and contains a myriad of other tax law changes. On September 13 2021 the House Ways Means Committee of the US.

The Legislation includes significant tax proposals that if passed will dramatically change the tax and estate planning landscape for high-income and high-net worth individuals. Instead it contains three primary changes affecting estate and gift taxes. The latest version a revised 175 trillion.

Estate is 16000000 Exemption 1000000. 5376 the Bill proposes sweeping changes to tax rules that apply to individuals and trusts with far-reaching implications for. The current 117M1 estate and gift tax exclusion was provided under a temporary law.

Gift in 2021 of 11000000. On November 1 2021 the House Rules Committee reported out the Build Back Better Act Reconciliation Bill which leaves out most of the proposed changes to the estate tax. The 117M per person gift and estate tax exemption will remain in place and will be increased.

House of Representatives released the draft text of its proposed budget reconciliation bill the Build. What tax hikes are in the social policy and climate change bill that Democrats are trying to pass by year-end. Estate planning changes dropped from US budget reconciliation Bill.

Reduce the current 11700000 per person gift and estate tax exemption the unified exemption by approximately one half. 107-16 among other tax cuts provided for a gradual reduction and elimination of the estate tax. The amended change would raise the cap to.

Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. All major provisions of the House Ways Means Committees budget reconciliation tax bill would cut 2022 taxes on average for households making 200000 or. The giftestate tax exemption currently is 10 million adjusted for inflation 117 million in 2021.

Estate and gift tax exemption. Some of the changes most likely to impact clients include. The proposal reduces the exemption from estate and gift taxes from.

Thursday 04 November 2021.

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Senators Propose Sweeping Changes To The Taxation Of Estates And Inherited Gains

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

The House Ways And Means Committee Reports On Tax Law Changes

Proposed Tax Law Changes Which May Impact You Certilman Balin

How The Tcja Tax Law Affects Your Personal Finances

The Tax Cuts And Jobs Act Doesn T Comply With The Byrd Rule Committee For A Responsible Federal Budget

How The Tcja Tax Law Affects Your Personal Finances

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

Income Estate Capital Gains Tax Hikes Retirement Account Crackdown House Finally Details How It Will Fund 3 5 Trillion Social Policy Plan

History Of The Unified Tax Credit Apple Growth Partners

Struggle Over Tax Break For Inherited Farmland Churns Below Surface In Reconciliation Bill Idaho Capital Sun

How The Tcja Tax Law Affects Your Personal Finances

Five Tax Implications Of The Budget Reconciliation Bill For Retirees Wealth Management

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

House Ways Reconciliation Bill For Trusts Estates And Wealthy